¶ 1. Money management

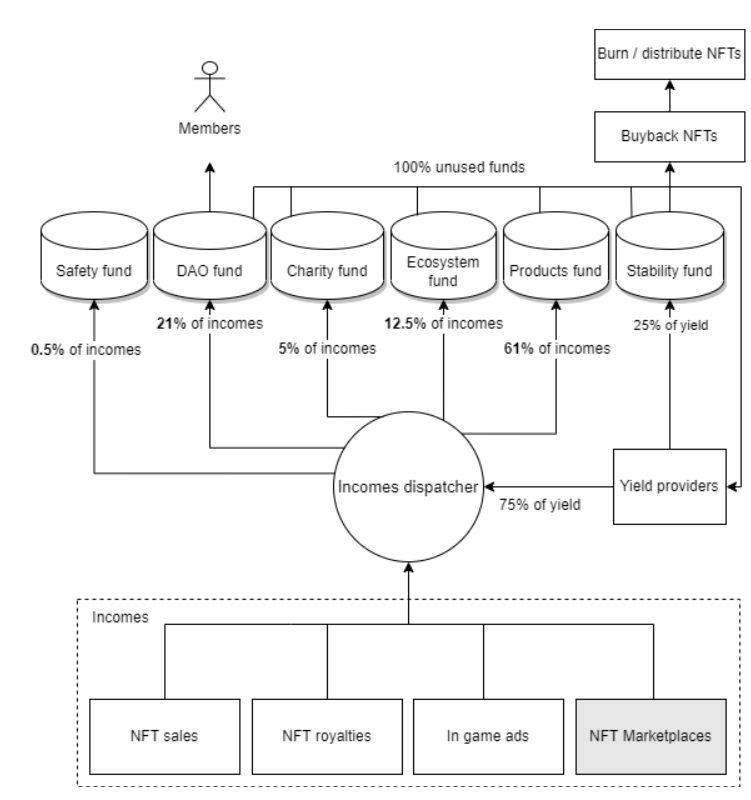

Here is a diagram that summarizes the money flow within System-1337:

Initially, the system will be mainly funded through royalties from the sale of NFTs between gamers, as well as the sale of NFTs prior to the release of each game and from NTFs related to in-game advertising. All income received by System-1337 is processed by the income dispatcher, which distributes it to the different funds the ecosystem. Any unused funds are invested through partners to generate yields. Three quarters of these returns are returned to the income dispatcher, which redistributes them to the relevant funds, while the remaining quarter is added to a stability fund. Each of these points is explained in more detail in the following sections.

¶ 1.1 System-1337 wallets

All of the DAO's funds are stored in wallets owned by Systemleet OÜ.

¶ 1.1.1 Security of funds

¶ 1.1.1.1 Security of funds

The funds are stored in “3-of-5” multisig wallets. That means that each wallet has five keys, each owned by another physical person. Any transactions must be signed by at least three of the five keys.

As an additional security measure, only transactions to whitelisted addresses are authorized. A list of whitelisted addresses is defined in the smart contracts. This list will contain addresses that System-1337 works with, such as addresses of partner studios or addresses of LP protocols contracts. The DAO can vote to add or remove addresses from the whitelist. With this solution, even with three of five signatures, transactions to addresses that have not been validated by the DAO cannot be initiated.

¶ 1.1.1.1 Security of funds

All funds, except for those dedicated to be used as game rewards, will be changed into stablecoin (see Appendix I - Accounts) in order to protect them from the volatility of crypto-currency markets. This primarily applies to royalties that are expected to be received from marketplaces in $EGDL.

¶ 1.2 Incomes

¶ 1.2.1 NFT Royalties

The main source of revenue is royalties from the trading of NFTs. Each time an item is sold by a gamer to another, 5% of the sale will be returned to the DAO. This applies as well when an item is resold, there is no limit to this.

In addition to game items, other types of NFTs will be deployed as the ecosystem develops. An example of this would be NFTs related to in-game advertising (Chap 10.2 System-1337 Pub). These new types of NFTs will further increase royalty revenues.

¶ 1.2.2 NFT Presale on each games

Each game will have its own collection of NFTs. It is planned to organize a special sale for it, which will include some NFTs from the collection as well as some exclusive items that will not be available as game rewards. Although the income will be distributed throughout the ecosystem like any other income, this type of sale can be seen as a fundraising action that will support the development of a game.

¶ 1.2.3 Yields

The MultiversX project is a blockchain platform that offers facilities for several types of domains, particularly in the area of Decentralized Finance. By holding the wallets, we have the opportunity to provide the DAO with access to the many opportunities it offers. Specifically, we are thinking of the ability to provide liquidity in “Liquidity Pool”, in order to generate yields on stablecoins deposited in the various wallets.

¶ 1.3 Protect and burn

The "Protect & Burn" mechanism is used to maintain the value of the DAO members' capital. When the floor price of NFTs drops, funds from the Stability account (Chap 2.7 The Stability account are used to buy back NFTs on marketplaces. These NFTs are then destroyed. For security reasons, the rules used by this mechanism are not publicly disclosed.